Economic value flows unevenly through systems. By better understanding their system, employees and entrepreneurs can strategically position themselves in its most critical segments, enhancing their professional worth. This positioning is even more important with the emergence of ChatGPT and other AI technologies, which can shock different pieces of the chain. Given my focus on real estate, I'm particularly intrigued by how value flows and accumulates across that ecosystem.

In this piece, I will walk through the real estate value chain, estimate the value of the links, and try to determine who are the winners and losers in an AI world.

Industry Structure

To start, consider the “mind map” below of the scope of commercial real estate real estate I want to address. This is a complicated industry, with lots of mouths to feed.

All the players have their role in the process of building, buying, managing or selling a property. Each player relies on the pieces before, with value accumulating along the way.

Real Estate Value Chain

Below is my proposed commercial real estate value chain.

The development value chain business has seven links, and the acquisition business has six. Both types of businesses are further supplemented by “support services” (e.g. legal, accounting, environmental) and “technology solutions” which offer support horizontally across many different links.

Billions of dollars of value are created across this value chain. Consider a small local developer who builds duplexes. He decides on a strategy, buys a site, raises capital, builds the property, leases, manages and then sells it. Blackstone follows this same process of strategy through disposition, just with more zeroes.

All of us sit somewhere along this value chain, hopefully contributing value. Do you sit in the right seat? What are some interesting questions to bounce off this framework? A few, below.

1. How many people work at each point of this chain?

2. What are the most important pieces of this chain? What is most valuable?

3. What are key areas of differentiation across each of these areas? Who is great at each one?

4. Where should technology be directed to help improve performance?

5. I’m entering the industry. What part should I join?

6. How will AI impact each of these? How does that inform your business or career?

How Large is Each Piece?

There is roughly $20 trillion of commercial real estate in the U.S. And by our[1] estimate there are roughly 2-3 million people working in commercial real estate. That implies $10,000 of real estate value for each real estate employee. This might be a nonsense number that nobody has ever calculated, for good reason. But it seems to me like that is a large pool of workers and if Elon and Vivek were around, they would be curious. If there is bloat, AI will find it.

The estimated workforce for each of our eight links is shown below. There is overlap amongst these functions, as some acquisitions people also divest and might raise capital, etc.

The largest employment categories are construction, property management and support services such as brokers and lawyers. These are secondary players that require something to happen. They need properties to sell, or companies to lease or developers to build. Most fundamentally, they require that capital be invested.

The size of the workforce of each link does not determine which is most valuable (in fact it’s more likely negatively correlated), but it does offer a bullseye for ChatGPT.

What are the most valuable pieces of the CRE Value Chain?

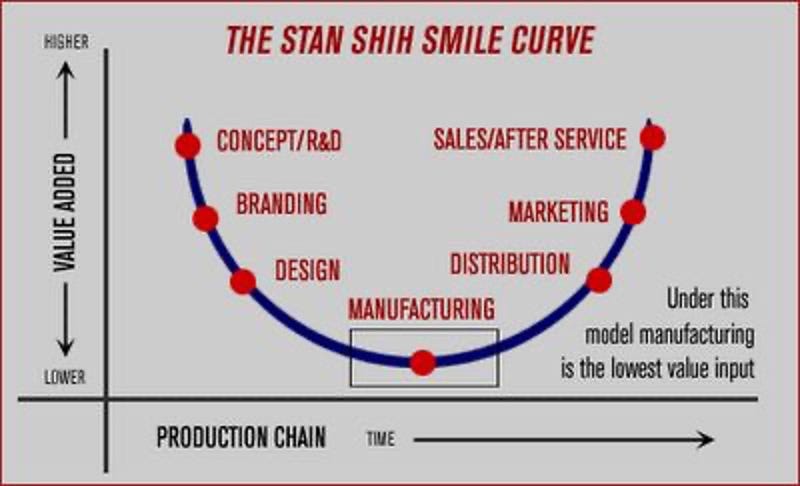

In manufacturing, the “smile curve” suggests that the most valuable pieces of the manufacturing process are in the beginning (design, IP) and the end (distribution).

As an example, an iPhone retails for $1,500 but costs about $500 (labor and parts) to make. The most valuable part of that value chain is the design and the IP at the very front end, and the margins at distribution in the Apple Store. The same process happens with new drugs and Teslas and other high-value, high margin goods.

Some parts of the value chain are commoditized while other are differentiated. We all should want to sit in the differentiated seat and outsource the commoditized parts.

For the real estate value chain, it is challenging to quantify in the same way as the iPhone. Trying to zero in on this question, we can examine a few different ways:

· What is the ROI on each piece? If you could add an internal investment to any piece where would the payback be the greatest?

· Which parts are easiest to outsource to consultants?

· Where has the most wealth been created? What are the real estate billionaires best at?

· Who are the great real estate players and where do they sit along this spectrum?

Before sitting down to write this piece, I had never really thought about this question. Below are my guesses, as well as industry estimates for the mid-point salary of a mid-career employee in each link.

Where do people create wealth? I don’t know any billionaire strategists, property managers or asset managers. People make a lot of wealth doing acquisitions (and this usually ties to dispositions as well). Developing strategies and sourcing land sites are differentiated and proprietary but much of the construction and leasing businesses are routinely outsourced to third parties. These are all signals. I would argue that acquisition and disposition are more easily outsourced and commoditized than is asset management. However, industry wisdom and compensation figures disagree with me.

My conclusion is that the ability to raise capital is the most crucial real estate skill. This might be a jaded conclusion, but real estate is a capital-intensive asset class, which makes the ability to raise it even more important than in other industries like technology or media. This is the most valuable piece of the real estate value chain.

After that, I would argue that asset management is the next most important. The ability to creatively manage and increase the value of existing real estate will be even more important in a changing, data-rich world.

How Will AI Impact the Different Pieces of the Value Chain?

Artificial Intelligence can do several of the tasks required in this industry. An AI engine cannot do a property manager’s job, but it can do pieces like scheduling maintenance requests and tracking rent payments. Similar for roles in research, legal and acquisition. The *hope* is that being supplemented with AI makes the person even more valuable in their role.

The letter grades below reflect which portions of the value chain face less or more risk. On one extreme, the process of raising capital seems the most immune. There are tools that help manage relationships, but even generative AI can’t generate trust. On the other end are areas in support services such as basic legal services.

The process of new development is somewhat repeatable with enough variability and complication that it has been largely shielded from AI. But there are several firms chipping away at different pieces of this value chain. Packy McCormick offers an in-depth summary of Cuby’s approach to home building here. Miami-based Deepblocks helps developers with site selection and feasibility analysis. More comprehensively, Brad Hargreaves recently authored a piece entitled The Quest to Automate Real Estate Development.

The question is whether AI will make you or your firm more valuable or more expendable?

We all need to use the introduction of AI tools such as Claude and Gemini to take one step up the hierarchy of needs. Beyond doing things, we need to think strategically about “why” and be insightful about the next logical question. Creativity is more important than ever and building relationships remains paramount. Bringing your boss questions in addition to answers will be your AI shield.

How Will the Value Chain Change in the Future, and Who are Winners and Losers?

ChatGPT was released two years ago, so we are only in the early innings, but AI is already impacting pieces of the value chain. Where will the chain evolve from here? Let’s step back and consider what typically happens when technology is added to a other existing industries or processes:

· Reduction in routine jobs

· Higher productivity per employee

· Higher profit margins

· Emergence of “tech-enabled” competitors

· “Winner takes most” dynamics

· Emergence of platform businesses

· Shift from product to service models

· Increase in data monetization

· Rise of subscription models

· Integration of physical and digital offerings

All of these are happening in real estate, and this will continue. The successful employees, entrepreneurs and firms will continue to lean in and welcome the uncertainty as the industry squeezes the juice out of the current $10,000 of market cap per worker.

Winners:

- Operational real estate, with a service mindset. Hospitality will continue to blend into all sectors.

- Nimble developers that can be first movers with tech tools to find undervalued sites

- Holders of unique data (large brokers, REITs, etc.)

- Platforms like Cherre that can simplify the world for users and help data holders monetize their assets.

Losers:

- Small property managers

- Small local brokers

- Traditional market research, appraisal, model, valuation firms

In my view, the most valuable skills in this evolving industry are 1. raising capital and 2. working creatively to add value at the asset level. While asset management has not historically been seen as a sexy sector, I think in the future it will become even more important, potentially even more than the traditionally more popular acquisition roles.

As I think about the keys to success for real estate firms and entrepreneurs, I suggest three that inspire me:

1. Get big, to allow for internal investment to further differentiate

2. Get more digital

3. Get better at asking questions

Happy 2025!

[1] Claude and I